Apple does not break out sales of its debut wearable, the Apple Watch, so it’s up to analysts to stump up the sales estimates — and the latest to do so, Canalys, reckons the Apple Watch accounted for two-thirds of the smartwatch market in 2015, with more than 12 million units shipped by its count in total — and more than five million of those in the holiday quarter.

Canalys’ figures have early mover Samsung returning to second place, thanks to an improved design with its Gear 2 smartwatch that it says has proved more popular with consumers. Pebble took third place, according to the analysis, while Huawei was fourth — the latter establishing itself as the leading Android Wear OEM.

Turning to more basic fitness wearables, by Canalys’ count, more than 37 million basic fitness bands also shipped in the year, with Fitbit comfortably leading this category and setting a quarterly shipments record. China’s Xiaomi held onto second place, shipping some 12 million of its budget priced Mi Bands during 2015.

The analyst recorded growth of more than 60 per cent sequentially across all wearable bands — driven by what it dubbed “strong” holiday shipments for Fitbit, Apple and Garmin. Across the entire wearable bands segment, Fitbit led all vendors in the holiday quarter, followed by Apple and Xiaomi.

Canalys takes a positive view of Fitbit’s Blaze smartwatch, announced last month at CES. Although investors punished the company for perceiving it had strayed too close to Apple’s wearable, the analyst argues the Blaze is competitively priced and still “squarely focused on fitness”. Whereas the Apple Watch is a more multifaceted device, with fitness features as part of a more fashion/lifestyle-focused proposition.

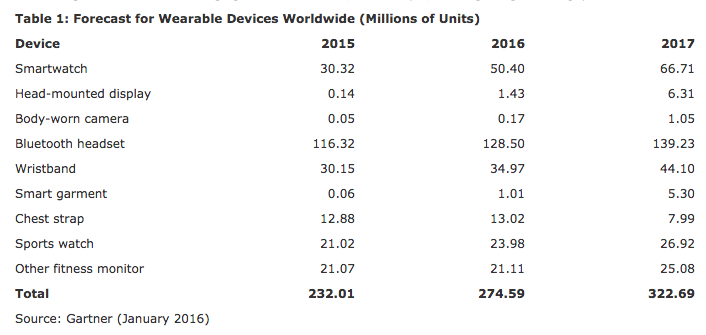

Analyst Gartner is also taking a positive view on the smartwatch space. Earlier this month it identified smartwatches as having the greatest revenue potential among all wearables through 2019 — forecasting they will be generating $17.5 billion by then.

It predicts sales of wearables overall will generate revenue of $28.7 billion in 2016 — out of which $11.5 billion will be from smartwatches, as Apple’s entry into the category popularizes wearables as a lifestyle trend.

Gartner is less bullish about the near term prospects for head mounted wearables, such as the clutch of VR headsets due to launch this spring (e.g. Facebook’s Oculus Rift and the HTC-Valve Vive) — characterizing the space as “an emerging market”.

And while it says it anticipates wearable headsets moving “towards mainstream adoption” in 2016, it’s only envisaging 1.43 million units shipping this year — vs 50.4 million smartwatches. So that’s some pretty baby steps towards anything approaching mainstream adoption.

Even smartwatches are going to remain far behind the mainstream adoption of smartphones, as Gartner notes — which again is unsurprising as all wearables are supplementary devices. None as currently envisaged purports to be a smartphone replacement.

“Though the sales of smartwatches are the one of the strongest types of wearables, their adoption will remain much below sales of smartphones,” said Gartner analyst Angela McIntyre in a statement. “For example, in 2016 more than 374 million smartphones will sell in mature market countries and in large urban areas of emerging market countries, for example, in Hong Kong and Singapore.”

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation.

0 comments:

Post a Comment