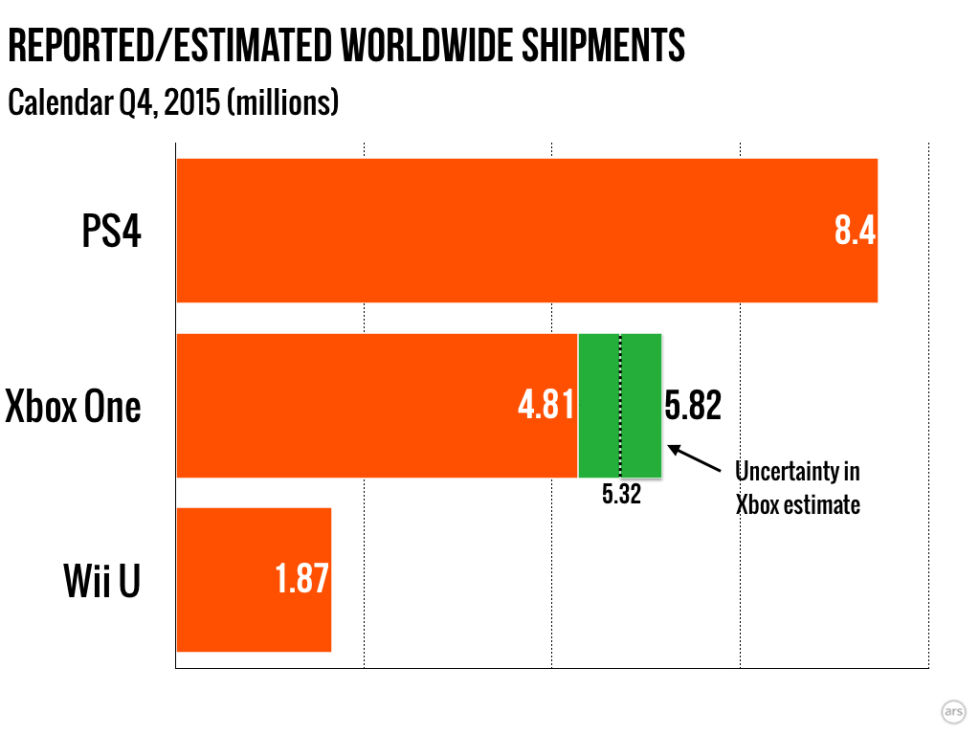

In recent earnings reports for the fourth calendar quarter last year (October through December), Sony announced shipments of 8.4 million PS4 units to retailers (Fig. 1), a record for the system and a 2 million unit improvement from the 2014 holiday quarter (more on the difference between shipments and "sell-through" below). Nintendo, however, announced 1.87 million shipments of Wii U hardware. That marks the system's second straight year of slight decreases in holiday performance, which came despite the availability of well-regarded 2015 releases like Splatoon and Super Mario Maker.

As is expected by now, figuring out actual shipment numbers for the Xbox One is a bit more difficult. Microsoft no longer even offers combined "Xbox family" hardware shipment details in its earnings reports, instead using Xbox Live subscriptions as a proxy for the health of its audience.

The company did obliquely hint at the Xbox One's relative performance in its latest earnings report through the following quote:

The statement actually reveals quite a bit about the Xbox One's year-over-year performance. We know that holiday shipments of the Xbox One went up ("higher console volume"). We also know that shipments didn't go up too much because revenue still decreased (due to "lower prices of consoles sold").

Using some math jujutsu (and some informed assumptions about how many consoles sold before and after each year's holiday price drops during the holiday quarter) we figured that Xbox One fourth quarter shipments could have gone up by at most 14 percent year-over-year. Any more than that and Xbox One revenue would have probably increased, despite the lower price, rather than decreasing as Microsoft said.

With that ceiling in place (and the floor of a minimal "higher console volume" increase), we used a midpoint estimate of a 7 percent year-over-year increase for Xbox One shipments. Applying that system to the holiday numbers that we generated for the fourth quarter of 2014 (themselves an estimate), you get the numbers in Fig. 1 above: 4.81 to 5.82 million holiday quarter shipments for the Xbox One.

Sanity check

This time around, we actually have a way to do a sanity check on our long-term Xbox One estimates. Last week, EA executive Blake Jorgensen let slip internal estimates of roughly 55 million units sold between the Xbox One and the PS4. With Sony claiming 35.9 million of those sales (through the end of 2015), that leaves roughly 19.1 million Xbox Ones sold over the life of the system.

That's actually a bit lower than our current estimate of lifetime Xbox One shipments, which runs from 19.84 million at the low end to 23.12 million at the high end (Fig. 2). Part of the difference, though, is probably because our numbers look at the shipments reported in quarterly earnings reports rather than the smaller sell-through to end users over the same time.

Jorgensen's earnings call estimate of "55 million units out there" is a little ambiguous, but he was likely referring to sell-through—the number of owners that are actually "out there" and capable of buying/playing EA games. Moreover, Sony's reported 35.9 million PS4 units through the end of the year was explicitly referring to sell-through—company earning reports actually put lifetime PS4 shipmentsthrough 2015 at 37.7 million in the same time.

In other words, at the end of 2015, worldwide retailers had about 1.8 million shipped PS4 units still sitting on store shelves waiting to be sold to the end customer (those units will doubtless actually be in customers' hands after a month or so if current PS4 sales rates are any indication). Even if we assume there were only a million Xbox One systems sitting in retail inventory at the same time (a conservative estimate), then the Xbox One's 19.1 million estimated lifetime sales translates into 20.1 million estimated lifetime shipments—which is just inside the low end of our estimated range.

A new generation of sale success

There's enough wiggle room in all of these numbers that the actual number may be a little higher or a little lower, and EA's leak suggests that the low end of our range might be more reliable than the high end. None of that information is very important to the bottom-line console comparison, though.

Even with extremely friendly assumptions, the PS4 extended its overall sales lead on the Xbox One by over 2.5 million units during the holiday quarter. That means that since the end of 2014, Sony's overall share of the worldwide three-console market has continued to creep up (from 48.3 percent to 52.5 percent) while the Xbox One's share has remained relatively stagnant (29.4 percent to 29.9 percent by our mid-point estimate) (Fig. 4)

This is obviously not good news for Microsoft. If current trends continue, there could easily be twice as many PS4s as Xbox Ones in gamers' hands worldwide by the end of 2016, which would be a troubling milestone for Microsoft. But that's only a problem as far as intra-generation competition is concerned. From an inter-generational standpoint, both the PS4 and the Xbox One are already stratospheric successes.

The shipment numbers tell the tale. If you align the shipments for the PS3/Xbox 360 and PS4/Xbox One by the number of total quarters they've been on the market (including each system's partial holiday launch quarter), this latest generation of hardware is off to a much faster start for both Microsoft and Sony. While the numbers bounced up and down for the first year or so, both the PS4 and Xbox One have settled into absolute sales rates much better than their predecessors had at the same age; about 77 percent better for the PS4 vs. the PS3, and about 97 percent better for the Xbox One vs. the Xbox 360 (Figure 6).

Looked at another way (as you can see in Fig. 5), the size of the worldwide market for the Xbox One has tracked quite closely with that of the PlayStation 3 at the same age. Yet the PS3 wasn't considered a failure at the time; in fact, it was selling well ahead of the Xbox 360's launch-aligned sales pace (thanks largely to Microsoft's sales struggles in Japan and other non-Western markets).

In other words, the Xbox One only looks like a relative sales failure because it's being compared to the runaway success of the PS4, which has far outpaced anything from the last console generation (and is tracking closer to the market-dominating PS2 at the beginning of the century). Judged by the standards of its predecessors, the Xbox One is selling just fine.

If the PS3 was successful enough to maintain significant support from video game developer publishers, the similar base of customers for Xbox One games should theoretically be on pace to do the same, regardless of its relative position compared to the PS4. Maybe that's what Xbox chief Phil Spencer meant when he recently said, "We're not motivated by beating Sony; we're motivated by gaining as many customers as we can."

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation.

0 comments:

Post a Comment